Source: https://tinyurl.com/rhawysb

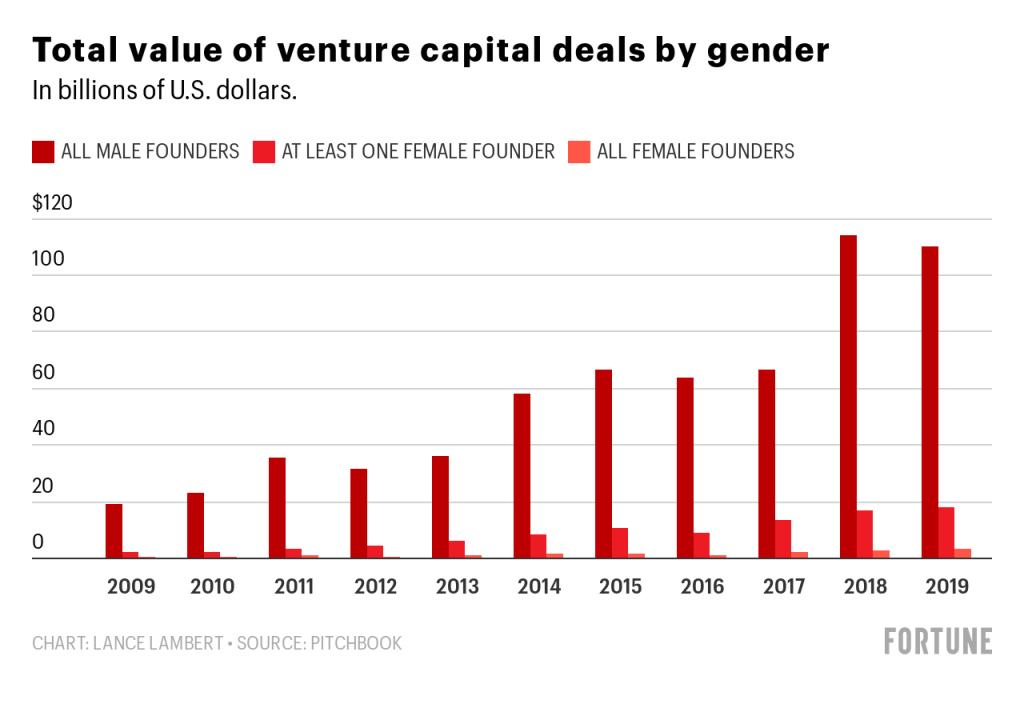

How will have to female founders mirror on 2019? From a statistical standpoint, the 12 months may just for sure be observed as step ahead: the proportion of VC greenbacks that flowed into startups based via a girl or a gaggle of ladies crept up over 2019, hitting $3.54 billion, or 2.7% of general funding.

But a extra holistic take a look at the project capital panorama places that stat in a moderately other standpoint. Consider WePaintings, arguably probably the most infamous startup flameout of the 12 months, if no longer the last decade. In 2019, funding juggernaut SoftBank poured no less than $Five billion into the imploding co-working corporate. That’s about $1.Five billion greater than the entire VC funding in all female-founded corporations mixed throughout the similar length, in accordance to knowledge supplied to Fortune via PitchBook, an organization that tracks knowledge from the project capital and personal fairness industries.

“It’s the most visible public argument that could be made for why gender diversity in founding teams, in cap tables, at the board level, and in management at a company is compelling,” Pam Kostka, CEO of the group All Raise, which advocates for ladies in startups and project capital, says of the WePaintings comparability. 2019 isn’t the primary time the cash funneled into female-founded corporations has paled in comparability to different investor darlings: in 2018, female founders landed $10 billion lower than Juul after a company mega-investment in the e-cigarette corporate.

The $3.54 billion that went to corporations based only via ladies accounts for a moderately greater proportion than such startups took in in 2018: 2.7% vs 2.2%. That’s nonetheless underneath 2014’s top, via share, of three.1%. Another $14.76 billion, or 11.5% of the entire pot, went to mixed-gender founding groups in 2019.

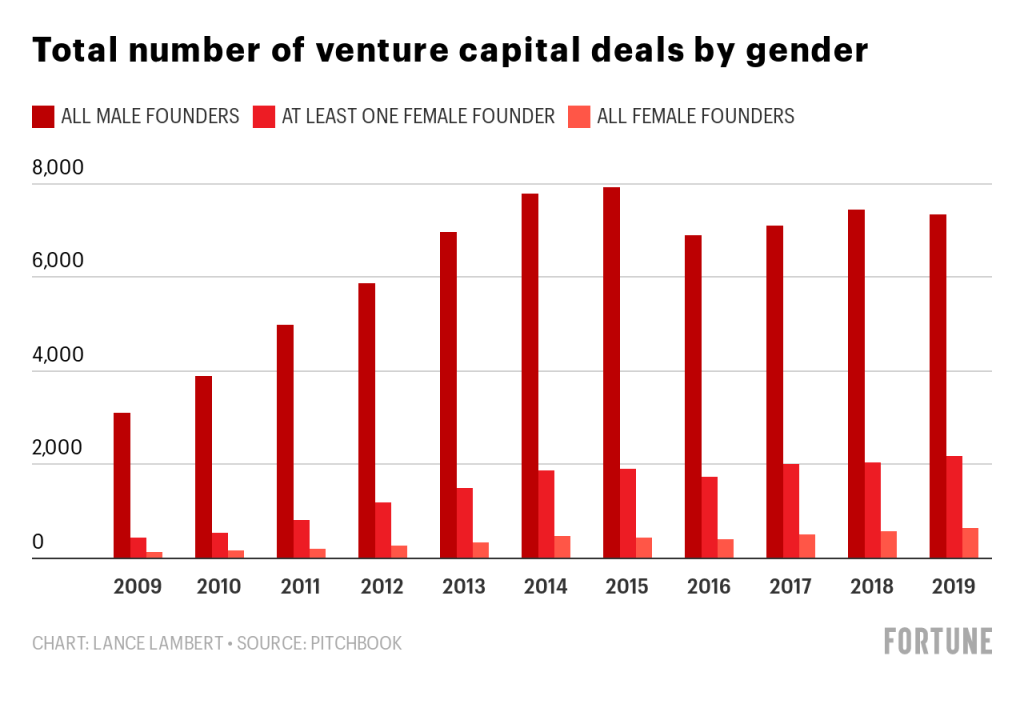

Women didn’t fare significantly better in phrases of the entire choice of VC offers accomplished. Investors shelled out for 648 general offers backing female-only founding groups—when put next to 7,336 transactions for all-male founding groups. All-female groups were given 6.8% of general VC offers via that metric.

The distinction between percentages via greenback quantity and via choice of offers—2.7% when put next to 6.8%—presentations every other hole, this time in the scale and degree of the offers project capitalists are backing for ladies. The reasonable deal for a female-only founding staff was once $6.6 million; the typical for an all-male founding staff was once $17.1 million. The median deal measurement for a female-only founding staff was once $1.nine million when put next to an all-male staff’s $3.Five million.

Most of the cash going to female-founders—$1.58 billion—went to corporations elevating cash after they’re regarded as early degree, at Series A or B as outlined via PitchBook; 236 such offers have been closed via all-female-founded corporations in 2019. That investment drops off moderately for later-stage investment in Series C rounds and past: $1.44 billion divvied up amongst 95 offers remaining 12 months.

Male founders, via comparability, see a dramatic build up in general investment transferring from early to past due phases, the place rounds generally tend to be greater: $32.19 billion in early phases and $69.34 billion in past due phases.

That discrepancy isn’t one thing that may be erased briefly, says Kostka; till extra female-founded corporations are funded adequately in the early phases and develop a success to the purpose the place they are able to drum up later-stage rounds, the distance will stay.

While PitchBook does monitor the scale of corporate exits via gender, the pattern measurement is small. Some notable exits for female-founded corporations in the previous 12 months come with the April preliminary public providing of CEO Jennifer Tejada’s PagerDuty, which noticed the inventory skyrocket 60% on its first buying and selling day to a $1.Eight billion valuation, and the July IPO of founder and CEO Julie Wainwright’s TheRealReal.

Parsing particular person rounds additionally sheds some mild at the 12 months in the investment female founders. The greatest deal for an all-female-founded corporate in 2019—$157 million for Rachel Romer Carlson and Brittany Stich’s Guild Education—was once nonetheless greater than $440 million lower than the 10th-largest deal for all-male founding groups remaining 12 months.

It’s no longer all unhealthy information: 2019 was once a outstanding 12 months for female-founded corporations changing into unicorns—startups valued at greater than $1 billion. The $125 million spherical in March for Jen Hyman’s Rent the Runway that introduced the corporate to unicorn standing was once the 3rd best deal of the 12 months for an organization based only via ladies. Glossier’s $100 million Series D spherical in the similar month did the similar for the wonder logo based via CEO Emily Weiss.

Four female-founded corporations, together with Glossier, raised precisely $100 million in 2019, making a four-way tie for the fourth-biggest deal of the 12 months for female founders. One of the ones different $100 million money infusions went to Away, the bags startup based via Jen Rubio and Steph Korey that has confronted turmoil in contemporary months over Korey’s management taste as leader govt.

The different offers a few of the most sensible 10 belong most commonly to biotech corporations like SpringWorks Therapeutics, based via Lara Sullivan (even though she now not serves at the corporate’s control staff); Talaris Therapeutics, based via Suzanne Ildstad; and Insitro, based via Daphne Koller.

The project companies that invested in probably the most female-founded corporations in 2019 come with Alumni Ventures Group, Precursor Ventures, Founders Fund, and Female Founders Fund. Over the previous decade, New Enterprise Associates has invested in extra female-founded corporations, with 53 general offers, than different companies; the company in 2nd position via that measure, Golden Seeds, subsidized 46.

From the funder standpoint, 2019 noticed a modicum of development. According to All Raise, 54 ladies remaining 12 months have been named VC companions or common companions at companies with greater than $25 million in belongings below control (apart from lifestyles science and company VC companies). That’s an all-time file, beating 38 ladies named spouse in 2018. Most of the ones ladies are white and Asian; only two determine as black or Latinx.

However, the ones numbers nonetheless aren’t any place shut to parity in new appointments: greater than 70 males have been named spouse remaining 12 months. And the project global as an entire stays overwhelmingly male, with 65% of VC companies nonetheless missing a unmarried female spouse.

Despite the gradual price of development for ladies in VC and the investment going to female-founded corporations, monitoring those incremental beneficial properties is vital, says Kostka. While elevating project capital for sure does no longer ensure that luck, it does permit alternative.

“Women are not raising as much as men, so they have fewer opportunities to fail. Failure is part of the story in the early lifecycle of an organization,” says Kotska, who labored at a number of early-stage startups all the way through 20 years in Silicon Valley sooner than taking on All Raise. “We need to make sure women are getting enough capital to go through that learning process and achieve success on the other side.”

No comments:

Post a Comment