Monday, March 30, 2020

Sunday, March 29, 2020

Treasury, IRS and Labor announce plan to implement Coronavirus-related paid leave for workers and tax credits for small and midsize businesses to swiftly recover the cost of providing Coronavirus-related leave

Source: https://tinyurl.com/qpvkgpf

IR-2020-57, March 20, 2020

WASHINGTON — Today the U.S. Treasury Department, Internal Revenue Service (IRS), and the U.S. Department of Labor (Labor) announced that small and midsize employers can begin taking advantage of two new refundable payroll tax credits, designed to immediately and fully reimburse them, dollar-for-dollar, for the cost of providing Coronavirus-related leave to their employees. This relief to employees and small and midsize businesses is provided under the Families First Coronavirus Response Act (Act), signed by President Trump on March 18, 2020.

The Act will help the United States combat and defeat COVID-19 by giving all American businesses with fewer than 500 employees funds to provide employees with paid leave, either for the employee's own health needs or to care for family members. The legislation will enable employers to keep their workers on their payrolls, while at the same time ensuring that workers are not forced to choose between their paychecks and the public health measures needed to combat the virus.

Key Takeaways

For COVID-19 related reasons, employees receive up to 80 hours of paid sick leave and expanded paid child care leave when employees' children's schools are closed or child care providers are unavailable.

To take immediate advantage of the paid leave credits, businesses can retain and access funds that they would otherwise pay to the IRS in payroll taxes. If those amounts are not sufficient to cover the cost of paid leave, employers can seek an expedited advance from the IRS by submitting a streamlined claim form that will be released next week.

Background

The Act provided paid sick leave and expanded family and medical leave for COVID-19 related reasons and created the refundable paid sick leave credit and the paid child care leave credit for eligible employers. Eligible employers are businesses and tax-exempt organizations with fewer than 500 employees that are required to provide emergency paid sick leave and emergency paid family and medical leave under the Act. Eligible employers will be able to claim these credits based on qualifying leave they provide between the effective date and December 31, 2020. Equivalent credits are available to self-employed individuals based on similar circumstances.

Paid Leave

The Act provides that employees of eligible employers can receive two weeks (up to 80 hours) of paid sick leave at 100% of the employee's pay where the employee is unable to work because the employee is quarantined, and/or experiencing COVID-19 symptoms, and seeking a medical diagnosis. An employee who is unable to work because of a need to care for an individual subject to quarantine, to care for a child whose school is closed or child care provider is unavailable for reasons related to COVID-19, and/or the employee is experiencing substantially similar conditions as specified by the U.S. Department of Health and Human Services can receive two weeks (up to 80 hours) of paid sick leave at 2/3 the employee's pay. An employee who is unable to work due to a need to care for a child whose school is closed, or child care provider is unavailable for reasons related to COVID-19, may in some instances receive up to an additional ten weeks of expanded paid family and medical leave at 2/3 the employee's pay.

Paid Sick Leave Credit

For an employee who is unable to work because of Coronavirus quarantine or self-quarantine or has Coronavirus symptoms and is seeking a medical diagnosis, eligible employers may receive a refundable sick leave credit for sick leave at the employee's regular rate of pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days.

For an employee who is caring for someone with Coronavirus, or is caring for a child because the child's school or child care facility is closed, or the child care provider is unavailable due to the Coronavirus, eligible employers may claim a credit for two-thirds of the employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate, for up to 10 days. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Child Care Leave Credit

In addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to the Coronavirus, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Prompt Payment for the Cost of Providing Leave

When employers pay their employees, they are required to withhold from their employees' paychecks federal income taxes and the employees' share of Social Security and Medicare taxes. The employers then are required to deposit these federal taxes, along with their share of Social Security and Medicare taxes, with the IRS and file quarterly payroll tax returns (Form 941 series) with the IRS.

Under guidance that will be released next week, eligible employers who pay qualifying sick or child care leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and child care leave that they paid, rather than deposit them with the IRS.

The payroll taxes that are available for retention include withheld federal income taxes, the employee share of Social Security and Medicare taxes, and the employer share of Social Security and Medicare taxes with respect to all employees.

If there are not sufficient payroll taxes to cover the cost of qualified sick and child care leave paid, employers will be able file a request for an accelerated payment from the IRS. The IRS expects to process these requests in two weeks or less. The details of this new, expedited procedure will be announced next week.

Examples

If an eligible employer paid $5,000 in sick leave and is otherwise required to deposit $8,000 in payroll taxes, including taxes withheld from all its employees, the employer could use up to $5,000 of the $8,000 of taxes it was going to deposit for making qualified leave payments. The employer would only be required under the law to deposit the remaining $3,000 on its next regular deposit date.

If an eligible employer paid $10,000 in sick leave and was required to deposit $8,000 in taxes, the employer could use the entire $8,000 of taxes in order to make qualified leave payments and file a request for an accelerated credit for the remaining $2,000.

Equivalent child care leave and sick leave credit amounts are available to self-employed individuals under similar circumstances. These credits will be claimed on their income tax return and will reduce estimated tax payments.

Small Business Exemption

Small businesses with fewer than 50 employees will be eligible for an exemption from the leave requirements relating to school closings or child care unavailability where the requirements would jeopardize the ability of the business to continue. The exemption will be available on the basis of simple and clear criteria that make it available in circumstances involving jeopardy to the viability of an employer's business as a going concern. Labor will provide emergency guidance and rulemaking to clearly articulate this standard.

Non-Enforcement Period

Labor will be issuing a temporary non-enforcement policy that provides a period of time for employers to come into compliance with the Act. Under this policy, Labor will not bring an enforcement action against any employer for violations of the Act so long as the employer has acted reasonably and in good faith to comply with the Act. Labor will instead focus on compliance assistance during the 30-day period.

For More Information

For more information about these credits and other relief, visit Coronavirus Tax Relief on IRS.gov. Information regarding the process to receive an advance payment of the credit will be posted next week.

IR-2020-57, March 20, 2020

WASHINGTON — Today the U.S. Treasury Department, Internal Revenue Service (IRS), and the U.S. Department of Labor (Labor) announced that small and midsize employers can begin taking advantage of two new refundable payroll tax credits, designed to immediately and fully reimburse them, dollar-for-dollar, for the cost of providing Coronavirus-related leave to their employees. This relief to employees and small and midsize businesses is provided under the Families First Coronavirus Response Act (Act), signed by President Trump on March 18, 2020.

The Act will help the United States combat and defeat COVID-19 by giving all American businesses with fewer than 500 employees funds to provide employees with paid leave, either for the employee's own health needs or to care for family members. The legislation will enable employers to keep their workers on their payrolls, while at the same time ensuring that workers are not forced to choose between their paychecks and the public health measures needed to combat the virus.

Key Takeaways

- Paid Sick Leave for Workers

For COVID-19 related reasons, employees receive up to 80 hours of paid sick leave and expanded paid child care leave when employees' children's schools are closed or child care providers are unavailable.

- Complete Coverage

- Employers receive 100% reimbursement for paid leave pursuant to the Act.

- Health insurance costs are also included in the credit.

- Employers face no payroll tax liability.

- Self-employed individuals receive an equivalent credit.

- An immediate dollar-for-dollar tax offset against payroll taxes will be provided

- Where a refund is owed, the IRS will send the refund as quickly as possible.

Reimbursement will be quick and easy to obtain.

Small Business Protection

Employers with fewer than 50 employees are eligible for an exemption from the requirements to provide leave to care for a child whose school is closed, or child care is unavailable in cases where the viability of the business is threatened.

- Easing Compliance

- Requirements subject to 30-day non-enforcement period for good faith compliance efforts.

To take immediate advantage of the paid leave credits, businesses can retain and access funds that they would otherwise pay to the IRS in payroll taxes. If those amounts are not sufficient to cover the cost of paid leave, employers can seek an expedited advance from the IRS by submitting a streamlined claim form that will be released next week.

Background

The Act provided paid sick leave and expanded family and medical leave for COVID-19 related reasons and created the refundable paid sick leave credit and the paid child care leave credit for eligible employers. Eligible employers are businesses and tax-exempt organizations with fewer than 500 employees that are required to provide emergency paid sick leave and emergency paid family and medical leave under the Act. Eligible employers will be able to claim these credits based on qualifying leave they provide between the effective date and December 31, 2020. Equivalent credits are available to self-employed individuals based on similar circumstances.

Paid Leave

The Act provides that employees of eligible employers can receive two weeks (up to 80 hours) of paid sick leave at 100% of the employee's pay where the employee is unable to work because the employee is quarantined, and/or experiencing COVID-19 symptoms, and seeking a medical diagnosis. An employee who is unable to work because of a need to care for an individual subject to quarantine, to care for a child whose school is closed or child care provider is unavailable for reasons related to COVID-19, and/or the employee is experiencing substantially similar conditions as specified by the U.S. Department of Health and Human Services can receive two weeks (up to 80 hours) of paid sick leave at 2/3 the employee's pay. An employee who is unable to work due to a need to care for a child whose school is closed, or child care provider is unavailable for reasons related to COVID-19, may in some instances receive up to an additional ten weeks of expanded paid family and medical leave at 2/3 the employee's pay.

Paid Sick Leave Credit

For an employee who is unable to work because of Coronavirus quarantine or self-quarantine or has Coronavirus symptoms and is seeking a medical diagnosis, eligible employers may receive a refundable sick leave credit for sick leave at the employee's regular rate of pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days.

For an employee who is caring for someone with Coronavirus, or is caring for a child because the child's school or child care facility is closed, or the child care provider is unavailable due to the Coronavirus, eligible employers may claim a credit for two-thirds of the employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate, for up to 10 days. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Child Care Leave Credit

In addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to the Coronavirus, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Prompt Payment for the Cost of Providing Leave

When employers pay their employees, they are required to withhold from their employees' paychecks federal income taxes and the employees' share of Social Security and Medicare taxes. The employers then are required to deposit these federal taxes, along with their share of Social Security and Medicare taxes, with the IRS and file quarterly payroll tax returns (Form 941 series) with the IRS.

Under guidance that will be released next week, eligible employers who pay qualifying sick or child care leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and child care leave that they paid, rather than deposit them with the IRS.

The payroll taxes that are available for retention include withheld federal income taxes, the employee share of Social Security and Medicare taxes, and the employer share of Social Security and Medicare taxes with respect to all employees.

If there are not sufficient payroll taxes to cover the cost of qualified sick and child care leave paid, employers will be able file a request for an accelerated payment from the IRS. The IRS expects to process these requests in two weeks or less. The details of this new, expedited procedure will be announced next week.

Examples

If an eligible employer paid $5,000 in sick leave and is otherwise required to deposit $8,000 in payroll taxes, including taxes withheld from all its employees, the employer could use up to $5,000 of the $8,000 of taxes it was going to deposit for making qualified leave payments. The employer would only be required under the law to deposit the remaining $3,000 on its next regular deposit date.

If an eligible employer paid $10,000 in sick leave and was required to deposit $8,000 in taxes, the employer could use the entire $8,000 of taxes in order to make qualified leave payments and file a request for an accelerated credit for the remaining $2,000.

Equivalent child care leave and sick leave credit amounts are available to self-employed individuals under similar circumstances. These credits will be claimed on their income tax return and will reduce estimated tax payments.

Small Business Exemption

Small businesses with fewer than 50 employees will be eligible for an exemption from the leave requirements relating to school closings or child care unavailability where the requirements would jeopardize the ability of the business to continue. The exemption will be available on the basis of simple and clear criteria that make it available in circumstances involving jeopardy to the viability of an employer's business as a going concern. Labor will provide emergency guidance and rulemaking to clearly articulate this standard.

Non-Enforcement Period

Labor will be issuing a temporary non-enforcement policy that provides a period of time for employers to come into compliance with the Act. Under this policy, Labor will not bring an enforcement action against any employer for violations of the Act so long as the employer has acted reasonably and in good faith to comply with the Act. Labor will instead focus on compliance assistance during the 30-day period.

For More Information

For more information about these credits and other relief, visit Coronavirus Tax Relief on IRS.gov. Information regarding the process to receive an advance payment of the credit will be posted next week.

Saturday, March 28, 2020

What Does the Families First Coronavirus Response Act Mean for Employers?

Source: https://tinyurl.com/r6feolj

Written by: Jordy Dean

What Does the Families First Coronavirus Response Act Mean for Employers?

Applies to: All Employers with fewer than 500 Employees

Effective: April 2, 2020

Beginning April 2, 2020, the Families First Coronavirus Response Act (FFCRA) will require employers to provide protected paid leave and paid sick leave to employees through December 31, 2020.

First, the FFCRA’s Emergency Family and Medical Leave Expansion Act extends employee leave protections under the federal Family and Medical Leave Act (FMLA) as follows:

- Applicability: Private employers with fewer than 500 employees.

- Eligibility: Employees employed for 30 calendar days or more may request FMLA benefits for leave where the employee is unable to work (or telework) due to a need for leave to care for the son or daughter under 18 years of age of such employee if the school or place of care has been closed, or the child care provider of such son or daughter is unavailable, due to a public health emergency.

- Paid Leave: The first 10 days of leave are unpaid after which the employer pays the following:

- at least 2/3 of an employee’s regular pay rate;

- for the number of hours an employee is otherwise normally scheduled to work (for those with varying schedules, employers should use an average number of scheduled work hours over the six-month period just prior to the date of leave); and

- up to a maximum of $200 per day and $10,000 in aggregate.

- Duration of Leave: The total leave allocation, including paid and unpaid portions, is the full 12-week benefit under existing FMLA rules.

- Substitutions: Employers may not require an employee to substitute any leave, but an employee can choose to substitute any accrued vacation, personal, or sick leave during the initial unpaid portion of the leave.

- Restoration to Position: This provision requires an employer to restore the individual to the position they held prior to the leave, except for employers with fewer than 25 employees if:

- the employee’s position is eliminated due to economic conditions or other changes in operating conditions of the employer that affect employment and are caused by a public health emergency during the period of leave; and

- the employer makes reasonable efforts to restore the employee to an equivalent position, and, if unsuccessful, the employer makes reasonable efforts to notify the employee if an equivalent position becomes available within one-year following the leave.

- Special Rule for Healthcare Providers and Emergency Responders: An employer of an employee who is a healthcare provider or an emergency responder may elect to exclude such employee from this leave benefit.

- Applicability: Private employers or individuals employing fewer than 500 employees, and public entities with one or more employees.

- Eligibility: Employers must provide paid sick time to employees who are unable to work, or telework, regardless of how long the employee has been employed by the employer, under the following circumstances:

- Federal, state, or local quarantine or isolation order related to COVID-19;

- Advice by a healthcare provider to self-quarantine due to COVID-19-related concerns;

- Employee experiencing symptoms of COVID-19 and seeking a medical diagnosis;

- Employee’s need to care for an individual who is subject to an order or who has been advised to quarantine by a healthcare provider;

- Employee’s need to care for a son or daughter if the school or place of care closes or is unavailable due to COVID-19 precautions; or

- The employee is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services (HHS).

- Compensation: For reasons 1-3 above, employers must pay the greater of the employee’s regular pay, the minimum wage in effect under FLSA, or the state/local minimum wage rate in effect, up to a maximum of $511 per day and $5,110 in aggregate. For reasons 4-6 above, employers must pay 2/3 of the greater of the employee’s regular pay, the minimum wage in effect under FLSA, or the state/local minimum wage rate in effect, up to a maximum of $200 per day and $2,000 in aggregate.

- Duration:

- All employees, regardless of the length of employment, are entitled to: 80 hours, if full-time; or

- Hours cannot carry over from one year to the next and paid sick time ends on the next scheduled work shift immediately following termination.

- Employers who are healthcare providers or employers of emergency responders may elect to exclude such employees from this benefit.

- Employers may not require an employee to:

- search for a replacement employee to cover their hours as a condition of providing paid sick leave; or

- use other paid leave provided by the employer before the employee uses sick time under this provision.

the average number of hours over a two-week period, if part-time.

- Prohibitions and Enforcement

- Violation is a failure to pay minimum wage under the Fair Labor Standards Act (FLSA) and be subject to fines.

- Employers may not discharge, discipline, or discriminate against an employee who takes leave or has filed any complaint or proceedings with regard to this Act – employers willfully violating this will be subject to penalties of up to $10,000, or up to six months imprisonment, or both.

- Notifications and Disclosures:

- To the extent an employee is planning on exercising leave for this purpose, they should notify their employer as soon as is practicable. Likewise, after the start of the leave period, an employer may require the employee to follow reasonable notice procedures to substantiate continued paid sick time payments.

- Notices shall be posted in conspicuous places on the premises of the employer, where notices to employees (including applicants) are customarily posted; or in employee handbooks. The notice will be available by March 25, 2020.

- Exceptions: The Secretary of Labor has the authority to issue regulations to exclude certain healthcare providers and emergency responders from the definition of eligible employee and to exempt small businesses with fewer than 50 employees if this provision will jeopardize the viability of the business

Action Items

- Review the Act here.

- Have paid leave policies updated.

- Prepare for employee leave requests beginning April 2nd.

- Display required notice (available by March 25th).

- Review your financial planning now.

- Review your ability to comply with the FFCRA and isolation orders.

Wednesday, March 25, 2020

How Entrepreneurs Can Survive the Next Recession

Source: https://tinyurl.com/y25h634w

GUEST WRITER

Assistant Professor of Entrepreneurship and Records-Johnston Professor

There has been increasing talk of a burgeoning recession, whether because of a historically rare decade-long economic expansion or recent reports of an inverted yield curve, which is traditionally an indication of a downturn. Any recession is hard on all Americans, but it can be particularly devastating for entrepreneurs, who often have more to lose. Not only does an economic ebb add to the uncertainty of owning and running a business, but it also means opportunities become scarcer, with fewer potential partners willing to invest, consume and otherwise enter into deals.

Recessions, of course, are famously hard to predict, but even when there's mounting evidence of a looming crisis, it can be hard to anticipate timing and how it will affect your industry. Simply closing shop is no solution. It might not even be an option. A better strategy is to prepare for the worst and make your business downturn-proof. But how does one do that? Here are four things to think about that can help make your business recession-ready ... just in case.

1. Tweak your value offering.

Successful entrepreneurship is always about providing value, but that value always rests in the eyes of your customer. This does not change during a recession. In fact, it may be even more important to let value decide what you offer, how and when. Ask yourself not what the value of your offering is, but what it will be to your customers in bad economic times. If they are expected to prioritize differently, so should you.

2. Choose flexibility over cost.

A downturn brings less economic activity, so it seems intuitive to focus on cutting costs, but that might not be prudent. Production costs are typically lowered (and kept down) by making large upfront investments in capital goods like machinery and factories. For this to make sense, however, you need large sales volume to cover the cost of your fixed capital. This could be a disastrous move in a recession if customers hesitate to purchase. It may be much more important to be able to quickly and costlessly scale down production in response to the downturn. Flexibility, and especially downward flexibility, may be more important than average production cost.

3. Renegotiate contracts with suppliers.

When you begin to worry about a recession, it is likely that your suppliers and other stakeholders do too. That's when it's a good idea to start a discussion about what to expect and adjust contracts -- especially long-term contracts -- to better fit hard economic times. Your suppliers are better off if you stay in business even if it means they cannot sell as much as the contract guarantees. Discuss and negotiate possible tweaks or add downturn clauses that you can use if the economy starts tanking.

4. Think of it as an opportunity to expand.

A recession breeds pessimism, so it's natural to hold back and tighten the belt, but that's what everyone else is doing, which means competition is much lower and that asset prices fall. With increasing unemployment, it will be easier to hire skilled workers. For businesses that don’t tank with the economy, therefore, this is an opportunity to expand, and at a discount. So make sure to have enough money in the bank to take advantage of the potential buyer’s market a recession brings.

The proper way to anticipate an economic slowdown is not acting out of fear but preparing for what it might bring. Entrepreneurs who see the signs of a downturn and take the time to make their businesses recession-ready not only have a greater chance for survival, but can take advantage of the opportunities that it brings, and just maybe come out of it even stronger.

Recessions, of course, are famously hard to predict, but even when there's mounting evidence of a looming crisis, it can be hard to anticipate timing and how it will affect your industry. Simply closing shop is no solution. It might not even be an option. A better strategy is to prepare for the worst and make your business downturn-proof. But how does one do that? Here are four things to think about that can help make your business recession-ready ... just in case.

1. Tweak your value offering.

Successful entrepreneurship is always about providing value, but that value always rests in the eyes of your customer. This does not change during a recession. In fact, it may be even more important to let value decide what you offer, how and when. Ask yourself not what the value of your offering is, but what it will be to your customers in bad economic times. If they are expected to prioritize differently, so should you.

2. Choose flexibility over cost.

A downturn brings less economic activity, so it seems intuitive to focus on cutting costs, but that might not be prudent. Production costs are typically lowered (and kept down) by making large upfront investments in capital goods like machinery and factories. For this to make sense, however, you need large sales volume to cover the cost of your fixed capital. This could be a disastrous move in a recession if customers hesitate to purchase. It may be much more important to be able to quickly and costlessly scale down production in response to the downturn. Flexibility, and especially downward flexibility, may be more important than average production cost.

3. Renegotiate contracts with suppliers.

When you begin to worry about a recession, it is likely that your suppliers and other stakeholders do too. That's when it's a good idea to start a discussion about what to expect and adjust contracts -- especially long-term contracts -- to better fit hard economic times. Your suppliers are better off if you stay in business even if it means they cannot sell as much as the contract guarantees. Discuss and negotiate possible tweaks or add downturn clauses that you can use if the economy starts tanking.

4. Think of it as an opportunity to expand.

A recession breeds pessimism, so it's natural to hold back and tighten the belt, but that's what everyone else is doing, which means competition is much lower and that asset prices fall. With increasing unemployment, it will be easier to hire skilled workers. For businesses that don’t tank with the economy, therefore, this is an opportunity to expand, and at a discount. So make sure to have enough money in the bank to take advantage of the potential buyer’s market a recession brings.

The proper way to anticipate an economic slowdown is not acting out of fear but preparing for what it might bring. Entrepreneurs who see the signs of a downturn and take the time to make their businesses recession-ready not only have a greater chance for survival, but can take advantage of the opportunities that it brings, and just maybe come out of it even stronger.

For Savvy Entrepreneurs, an Economic Downturn Creates Opportunity

Source: https://tinyurl.com/wtb6ay5

GUEST WRITER

Co-Founder and CEO of Third Summit

As COVID-19 wreaks havoc on a global scale, market-watchers are worrying about signs of another recession. Already, major conferences like South By Southwest and Facebook F8 have been cancelled. Airlines are grounding flights. Studios and startups are postponing film and product launches. Global stock markets have plummeted, evaporating $9 trillion and counting.

Entrepreneurs are asking themselves a looming question: How can I protect my business during these uncertain times? It’s complicated, but I believe there is reason for optimism.

Economists have been skittish about a possible economic downturn for months now, stemming from a different threat: a Chinese trade war. But even as recently as last fall, small business leaders weren’t overly concerned. In Sept. 2019, the U.S. Chamber of Commerce updated their Small Business Index, finding record-high levels of confidence among small business owners: A majority of respondents said both their business and their local economy were in good health.

More recently, Sentieo, a financial research company, studied the market effects of the coronavirus outbreak in detail. Their findings are remarkable. While most companies’ value crumbled, they observed that several companies have actually been thriving, including file-management software Atlassian, video-conferencing software Zoom, remote healthcare company Teladoc and exercise bike–maker Peloton.

“We realized that this is the ‘Work from Home’ portfolio,” the study’s authors concluded. “We are witnessing the markets pricing around large-scale adoption of these names due to the coronavirus.”

This is huge news—not just for investors, but for entrepreneurs, too. And I see two major takeaways from the Sentieo study above.

Opportunities abound for companies that enable remote work

Firstly, it is an ideal time to invest in or create a company that encourages remote work. The Globe and Mail, a Canadian newspaper, expanded on Sentieo’s data and found a surge of high-level corporate calls mentioning remote work in February 2020. There were more than 100 mentions across major corporations, compared with the previously single-digit monthly average. Meanwhile, Growrk, a company that helps transform home offices into proper workstations, officially launched just six months ago. After COVID-19, they’ve seen a tenfold surge in client demand.

This is not new—remote work has been a growing trend for years now. But fears of COVID-19 have rapidly accelerated its mainstream appeal. This may well be a turning point in the future of work, which is moving away from nine-to-five office hours and toward flexibility and independence. For example, COVID-19 sharpened the reality that risk mitigation—regarding pandemic viruses or natural disasters—is a built-in advantage for remote workforces.

Recessions make room for disruption

The second takeaway is that recessions can create tremendous opportunities for market disruption. After the 2008 crash, two unicorn companies were born: Airbnb and Uber. Both found ways to disrupt old business models by empowering everyday people to find new revenue streams, offering creative, viable, affordable alternatives to traditional workplaces. The gig economy has always existed, but the Great Recession rocketed it to a whole new level. People suddenly found themselves unable to rely on our broken institutions. Self-employment was the solution.

This does not apply to every company, but recessions act as “filters” that weed out weak business models and force leaders to adapt.

Learn to be agile with low overhead costs and a desirable product

During the Great Recession, I witnessed the downturn devastate most marketing agencies. Debt loads soared. Cash flows ground to a halt. Costs were cut. Thousands of people got laid off, compounded by a mass scramble for work in a tightened creative field. According to several estimates, ad spends in the U.S. dropped 12 percent; worldwide, the industry saw a nine-percent fall.

My company, Cimaglia Productions, however, saw a banner year. After a few frugal months, brands rebounded, realizing they still needed to create content. Unlike a major ad agency, I kept our overhead costs low and knew a wide network of creatives (many of whom suddenly found themselves out of work), which perfectly positioned us to work both with big agencies and multinational brands directly. Between 2009 and 2010, we wound up more than doubling our revenue.

Here’s what I learned: Large companies, overly reliant on hefty retainers to fuel inflated overhead costs, suffer in a recession. The same is true of many industries, including media, tourism, finance and construction.

But the dips don’t last. And when the recession fades, your company can be poised to take advantage of the newfound business.

It sounds contradictory to point out that recessions hit small businesses the hardest, while also creating fertile ground for startups. But both are true. The crucial difference is one’s business approach. For entrepreneurs who can weather the storm, the global market volatility does not have to be a threat—it can be an opportunity.

Monday, March 23, 2020

Tax Day postponement to July 15 'welcome news' for small business

Source: https://tinyurl.com/s88ycdo

Author: Jane Thier@thier_jane- On Friday morning, Treasury Secretary Steve Mnuchin shared on Twitter that Tax Day would be pushed back from April 15 to July 15 as the nation attempts to cope with the impacts of coronavirus. Shortly after Mnuchin tweeted, the Internal Revenue Service announced the postponement officially.

- "At @realDonaldTrump’s direction, we are moving Tax Day from April 15 to July 15. All taxpayers and businesses will have this additional time to file and make payments without interest or penalties," Mnuchin wrote. "I encourage all taxpayers who may have tax refunds to file now to get your money."

- The decision comes after widespread complaints about the Trump Administration’s previous plan, announced earlier this week, to give people who owe the IRS an additional 90 days to pay, without penalties or interest, while still requiring them to file their returns by April 15, NBC News reported.

Per the IRS’ online announcement, the filing deadline for tax returns remains April 15, 2020. The office urges taxpayers who are owed a refund to file "as quickly as possible."

In its Wednesday announcement on the initial 90-day delay, the Internal Revenue Service cautioned that the delay applied only to federal income taxes, not state income taxes.

"Taxpayers also will need to file income tax returns in 42 states plus the District of Columbia," the agency said on its website. "State filing and payment deadlines vary and are not always the same as the federal filing deadline. The IRS urges taxpayers to check with their state tax agencies for those details."

Mnuchin had said Wednesday that, in light of the crisis, individuals can delay paying up to $1 million in tax payments and corporations can defer payments on up to $10 million. During the deferment period, neither individuals nor corporations would be subject to interest or penalty payments, he said.

The revised delay is another part of the government’s effort to keep $300 billion in the economy as individuals and corporations alike grapple with an unprecedented financial upset caused by the coronavirus.

As non-essential businesses are ordered to temporarily close and consumer spending dries up, many small business owners are struggling to keep their cash flow and revenue up to par, as well as retain their staff and provide for their customer base.

"Small business owners right now are dealing with enormous change and business continuity challenges," Jared King, co-founder CEO of automated accounts receivable software service Invoiced, told CFO Dive Friday. "So filling and paying taxes is really the last thing they need, given the circumstances."

King believes that for small businesses, the delay may be a lifeline in a situation that would otherwise have them risking bankruptcy.

"Deferring this year's tax preparation and payment will be welcome news for just about any small business, as it will give them a temporary cash management advantage to make payroll, cover supplier payables and continue operations," he said.

He clarified that putting aside concerns about paying and filing taxes on time would create the space to address more urgent concerns. "Perhaps more importantly," King said. "The ability to just not deal with taxes while they face other more existential challenges will be key."

In response to the pandemic, Invoiced is currently offering its accounts receivable automation function to nonprofits organizations for free. The program took effect last week and will continue being free for up to six months.

Saturday, March 21, 2020

Good Controller/Bad Controller

Source: https://tinyurl.com/r6r3af6

Written by: Adam C. Spiegel and Jeff Epstein

The “goldilocks” controller has the right mix of skills and interests for your current challenges with the ability to scale the company.Back in 2012, Ben Horowitz published an article titled “Good Product Manager/ Bad Product Manager.” We borrowed from his format as we assessed a key role in a fast-growing company’s finance organization: the controller. (See our previous column, Good CFO/Bad CFO.) Special thanks to Aman Kothari, Darko Socanski, and the Bessemer Venture Partners CFO Advisory Board for their contributions.

Finding the right corporate controller for the scale and stage of growth for your organization is critical. If your company is a small, fast-growing organization, a “big company” controller may be unable or unwilling to roll up their sleeves to lean in and help address your most important issues. If your organization is more mature, an outstanding, hands-on small company controller may have difficulty developing a strong team and thinking and acting strategically.

The “goldilocks” controller has the right mix of skills and interests for your current challenges with the ability to scale the company in the short-to-medium term. As an organization scales it isn’t unusual for the controller to either be upgraded or for a chief accounting officer to be hired over them to help bridge gaps.

Finding the right corporate controller for the scale and stage of growth for your organization is critical. If your company is a small, fast-growing organization, a “big company” controller may be unable or unwilling to roll up their sleeves to lean in and help address your most important issues. If your organization is more mature, an outstanding, hands-on small company controller may have difficulty developing a strong team and thinking and acting strategically.

The “goldilocks” controller has the right mix of skills and interests for your current challenges with the ability to scale the company in the short-to-medium term. As an organization scales it isn’t unusual for the controller to either be upgraded or for a chief accounting officer to be hired over them to help bridge gaps.

Whether you need a more nimble, hands-on controller or a big-picture, strategic controller, here are some common characteristics to consider in the selection and evaluation process.

A good controller can build and lead a strong accounting team. He or she hires the right people for the role and for the team and company culture. A bad controller is challenged on this front — he or she mis-hires and winds up doing all of the work themselves, then complains about it to everyone who will listen.

A good controller organizes for success. He or she designs their organization in a way that optimally supports the business now and that can be flexible to meet changing short-to-medium term needs. A bad controller hires bodies to “get the job done” and doesn’t have time to think about what comes next.

A good controller uses their innate understanding of each team member’s aspirations and limitations to get the best out of them. A bad controller can’t tell the difference between good talent and bad talent. He or she is afraid to upgrade the team because of the additional work they’ll need to do during the transition period.

A good controller sets clear expectations with the team and follows up. He or she sets goals for themselves and their team focused on continual process improvement. He or she asks lots of open-ended questions and learns from the answers. A bad controller does things the way the last controller did them without ever asking why. Bad controllers have no need to ask questions as they already know all of the answers.

At a smaller company, a good controller enjoys being hands-on and is happy with that as an ongoing part of their job, comfortably working both as a preparer and a reviewer. A bad controller in this size company resents having to do the detail work themselves and doesn’t bother to review the work of subordinates.

A good controller is quick to spread the credit and slow to spread the blame. He or she takes pride in the team’s successes and owns their failures. The same mistake doesn’t happen again because it becomes a teaching moment and a lesson is learned. A bad controller takes credit for others’ successes and blames others when things go wrong. There is no teaching and the same mistakes happen over and over again.A good controller “owns it.” He or she is willing to do whatever it takes to get the job done and will work shoulder to shoulder with the team during those long close or pre-audit nights. The bad controller punches out after their 8 hours regardless of what is going on in the office, leaving the team behind to fend for themselves.

A good controller is super service-oriented and ensures that the finance team delivers outstanding service to its customers (the rest of the enterprise). A bad controller doesn’t believe that finance has any customers and ignores the needs of the other departments.

A good controller communicates well, both within finance and to the broader organization, knowing that he or she is part of a collective team that only succeeds together. A bad controller works in a silo and doesn’t encourage collaboration.

A good controller understands processes, systems, and their underlying data and will work closely with engineering and IT partners to get the best out of their technology tools. A bad controller doesn’t implement systems projects because he or she can’t find the time. Bad controllers hold up the migration from QuickBooks because they like the flexibility to be able to go back to edit closed periods.

A good controller creates accurate financial statements on a predictable schedule and has a plan to improve upon their timeliness and comprehensiveness. He or she understands that getting to a faster monthly close means that the team will have more time each month for process improvement, making the next monthly close even better. In a larger private company, the good controller has a plan to reduce monthly close to a public company timeframe while also maintaining the sanity of the team. The bad controller uses the entire month (or more) to close the books, leaving no time for process improvement and leaving the team perpetually in a state of exhaustion and stress.

A good controller inherently understands and is fluent in the majority of the operational and technical accounting concepts relevant to the business. At a smaller company, the controller might not have the same depth of technical accounting knowledge but he or she will still be fluent in the key concepts so as to know when to ask additional questions or flag issues. The bad controller assumes that the auditors will figure out all of the technical accounting issues in the audit so he or she minimizes their effort expended on investigating them.

A good controller builds a strong and constructive working relationship with the audit partner and is unafraid to engage in honest and open dialog around critical internal issues. Good controllers communicate often and share the common goal of “getting things right” and avoiding surprises. The bad controller dreads every conversation with the audit partner out of fear that his or her incompetence will be exposed.

A good controller is ethically and morally grounded and is unafraid to challenge and engage with others at all levels of the organization in discussions about ethical issues. A bad controller lives in fear for their job and thus will hide from challenging issues.

A good controller projects gravitas and can partner well with executives and others across the organization. A bad controller is uncomfortable when interacting with others and it shows.

A good controller seeks out mentorship and guidance and is focused on self-improvement. A bad controller just “does their job” as he or she doesn’t have the bandwidth to do any more.

Adam Spiegel served as CFO for a series of public and private high growth technology companies including RPX and Glassdoor. Previously he spent over a decade as an investment banker for the Credit Suisse First Boston Technology Group and Prudential Securities, completing transactions valued at over $8 billion. He now mentors CFOs and advises other executives of high growth technology companies.

Jeff Epstein is an operating partner at Bessemer Venture Partners and a lecturer at Stanford University. He specializes in marketplaces and business-to-business software companies. He serves on the boards of directors and audit committees of Kaiser Permanente, Twilio, Shutterstock, and several private companies.

A good controller can build and lead a strong accounting team. He or she hires the right people for the role and for the team and company culture. A bad controller is challenged on this front — he or she mis-hires and winds up doing all of the work themselves, then complains about it to everyone who will listen.

A good controller organizes for success. He or she designs their organization in a way that optimally supports the business now and that can be flexible to meet changing short-to-medium term needs. A bad controller hires bodies to “get the job done” and doesn’t have time to think about what comes next.

A good controller uses their innate understanding of each team member’s aspirations and limitations to get the best out of them. A bad controller can’t tell the difference between good talent and bad talent. He or she is afraid to upgrade the team because of the additional work they’ll need to do during the transition period.

A good controller sets clear expectations with the team and follows up. He or she sets goals for themselves and their team focused on continual process improvement. He or she asks lots of open-ended questions and learns from the answers. A bad controller does things the way the last controller did them without ever asking why. Bad controllers have no need to ask questions as they already know all of the answers.

At a smaller company, a good controller enjoys being hands-on and is happy with that as an ongoing part of their job, comfortably working both as a preparer and a reviewer. A bad controller in this size company resents having to do the detail work themselves and doesn’t bother to review the work of subordinates.

A good controller is quick to spread the credit and slow to spread the blame. He or she takes pride in the team’s successes and owns their failures. The same mistake doesn’t happen again because it becomes a teaching moment and a lesson is learned. A bad controller takes credit for others’ successes and blames others when things go wrong. There is no teaching and the same mistakes happen over and over again.A good controller “owns it.” He or she is willing to do whatever it takes to get the job done and will work shoulder to shoulder with the team during those long close or pre-audit nights. The bad controller punches out after their 8 hours regardless of what is going on in the office, leaving the team behind to fend for themselves.

A good controller is super service-oriented and ensures that the finance team delivers outstanding service to its customers (the rest of the enterprise). A bad controller doesn’t believe that finance has any customers and ignores the needs of the other departments.

A good controller communicates well, both within finance and to the broader organization, knowing that he or she is part of a collective team that only succeeds together. A bad controller works in a silo and doesn’t encourage collaboration.

A good controller understands processes, systems, and their underlying data and will work closely with engineering and IT partners to get the best out of their technology tools. A bad controller doesn’t implement systems projects because he or she can’t find the time. Bad controllers hold up the migration from QuickBooks because they like the flexibility to be able to go back to edit closed periods.

A good controller creates accurate financial statements on a predictable schedule and has a plan to improve upon their timeliness and comprehensiveness. He or she understands that getting to a faster monthly close means that the team will have more time each month for process improvement, making the next monthly close even better. In a larger private company, the good controller has a plan to reduce monthly close to a public company timeframe while also maintaining the sanity of the team. The bad controller uses the entire month (or more) to close the books, leaving no time for process improvement and leaving the team perpetually in a state of exhaustion and stress.

A good controller inherently understands and is fluent in the majority of the operational and technical accounting concepts relevant to the business. At a smaller company, the controller might not have the same depth of technical accounting knowledge but he or she will still be fluent in the key concepts so as to know when to ask additional questions or flag issues. The bad controller assumes that the auditors will figure out all of the technical accounting issues in the audit so he or she minimizes their effort expended on investigating them.

A good controller builds a strong and constructive working relationship with the audit partner and is unafraid to engage in honest and open dialog around critical internal issues. Good controllers communicate often and share the common goal of “getting things right” and avoiding surprises. The bad controller dreads every conversation with the audit partner out of fear that his or her incompetence will be exposed.

A good controller is ethically and morally grounded and is unafraid to challenge and engage with others at all levels of the organization in discussions about ethical issues. A bad controller lives in fear for their job and thus will hide from challenging issues.

A good controller projects gravitas and can partner well with executives and others across the organization. A bad controller is uncomfortable when interacting with others and it shows.

A good controller seeks out mentorship and guidance and is focused on self-improvement. A bad controller just “does their job” as he or she doesn’t have the bandwidth to do any more.

Adam Spiegel served as CFO for a series of public and private high growth technology companies including RPX and Glassdoor. Previously he spent over a decade as an investment banker for the Credit Suisse First Boston Technology Group and Prudential Securities, completing transactions valued at over $8 billion. He now mentors CFOs and advises other executives of high growth technology companies.

Jeff Epstein is an operating partner at Bessemer Venture Partners and a lecturer at Stanford University. He specializes in marketplaces and business-to-business software companies. He serves on the boards of directors and audit committees of Kaiser Permanente, Twilio, Shutterstock, and several private companies.

Tuesday, March 17, 2020

Monday, March 9, 2020

Hispanic Employment in the United States Sets New Record High

Source: https://tinyurl.com/uuz8h9e

Written by: Carlos Dela Vega (staff@latinpost.com)

Hispanics are known as hard working people. They work night and day with few complaints just to provide the basic needs of their families. They are also becoming the main workforce of the United States.

There are millions of Hispanics who currently live and work in the country. Each of them wishing to have a job and hoping for a brighter future. It is one of the main reasons they decided to leave their place of origin and chose to live in the United States.

According to the U.S. Bureau of Labor Latinos (BLS), Hispanics are expected to have the most labor force growth from 2018 to 2028. They are expecting that there will be an increase of 7.4 million to 8.9 million Hispanic people in the workforce compared to other races and ethnicity.

In the recent report of BLS, the employed Hispanics for February this year have increased to 28,531,00 surpassing the employment in January which is estimated to be around 28,397,000. This means that an additional 134,000 Hispanics were added and employed in February.

Moreover, Hispanics' participation in the workplace has also increased. There were 29,852,000 who actively participated in their workplace for February. This is slightly higher compared to the 29, 672,000 in January. An increase of 180,000 Hispanics participated in their workplace.

Even though it is true that there is an increase in Hispanics' employment rate in the United States, the unemployment rate has also increased. According to a published article in CNS News, an increase of 4.4 percent of Hispanics and Latinos were recorded unemployed for February.

It is the highest unemployment rate since the Latino and Hispanic community has a record low of 3.9 percent unemployment rate in September 2019. This means that both the employment and unemployment rate among Hispanics and Latinos in the United States has increased.

The growth of Hispanic employment in the country is expected to increase as the Hispanic owners of small businesses are planning to expand and hire more employees. Hispanics are also opening more small businesses in the country compared to other ethnicities or races.

Meanwhile, President Donald Trump said during the Latino Coalition Legislative Summit that they were able to create more than 3 million jobs for Hispanic-Americans under his administration. He also mentioned that more Hispanics-Americans are now earning and can afford housing in the United States.

The aim of President Donald Trump to Make America Great Again (MAGA) has now clearly manifest. The creation of millions of jobs for the Hispanic-Americans means increasing the household income that will help their family to afford household, education, private healthcare services, and more.

The median household income has also reached its highest level in American history. Trump said that the median household income has surpassed $50,000 a year. This is indeed a good year to start the decade for the Hispanics in the United States.

They will greatly contribute both in the local and national economy of the country and will be the main workforce in the years to come. Hispanic owners of small business are contributing billions of dollars every year and Hispanic employees are helping the economy to work and grow.

|

| (Photo : Pexels) |

Hispanics are known as hard working people. They work night and day with few complaints just to provide the basic needs of their families. They are also becoming the main workforce of the United States.

There are millions of Hispanics who currently live and work in the country. Each of them wishing to have a job and hoping for a brighter future. It is one of the main reasons they decided to leave their place of origin and chose to live in the United States.

According to the U.S. Bureau of Labor Latinos (BLS), Hispanics are expected to have the most labor force growth from 2018 to 2028. They are expecting that there will be an increase of 7.4 million to 8.9 million Hispanic people in the workforce compared to other races and ethnicity.

In the recent report of BLS, the employed Hispanics for February this year have increased to 28,531,00 surpassing the employment in January which is estimated to be around 28,397,000. This means that an additional 134,000 Hispanics were added and employed in February.

Moreover, Hispanics' participation in the workplace has also increased. There were 29,852,000 who actively participated in their workplace for February. This is slightly higher compared to the 29, 672,000 in January. An increase of 180,000 Hispanics participated in their workplace.

Even though it is true that there is an increase in Hispanics' employment rate in the United States, the unemployment rate has also increased. According to a published article in CNS News, an increase of 4.4 percent of Hispanics and Latinos were recorded unemployed for February.

It is the highest unemployment rate since the Latino and Hispanic community has a record low of 3.9 percent unemployment rate in September 2019. This means that both the employment and unemployment rate among Hispanics and Latinos in the United States has increased.

The growth of Hispanic employment in the country is expected to increase as the Hispanic owners of small businesses are planning to expand and hire more employees. Hispanics are also opening more small businesses in the country compared to other ethnicities or races.

Meanwhile, President Donald Trump said during the Latino Coalition Legislative Summit that they were able to create more than 3 million jobs for Hispanic-Americans under his administration. He also mentioned that more Hispanics-Americans are now earning and can afford housing in the United States.

The aim of President Donald Trump to Make America Great Again (MAGA) has now clearly manifest. The creation of millions of jobs for the Hispanic-Americans means increasing the household income that will help their family to afford household, education, private healthcare services, and more.

The median household income has also reached its highest level in American history. Trump said that the median household income has surpassed $50,000 a year. This is indeed a good year to start the decade for the Hispanics in the United States.

They will greatly contribute both in the local and national economy of the country and will be the main workforce in the years to come. Hispanic owners of small business are contributing billions of dollars every year and Hispanic employees are helping the economy to work and grow.

Wednesday, March 4, 2020

Business Permit Office assists businesses in navigating Texas permitting

Source: https://tinyurl.com/sgh3j38

Business Permit Office

The Business Permit Office assists businesses in navigating Texas’ permitting, licensing and regulatory environment and aids in resolving permitting issues that arise. This office offers services to businesses of all sizes and resides within the Economic Development and Tourism Office at the Office of the Governor.

Ombudsman/Liaison

- Assists applicants in the resolution of outstanding issues identified by state agencies, including delays experienced in permit review.

- Aids applicants in obtaining timely and efficient permit review and in resolving issues arising from the review.

- Facilitates contacts between applicants and state agencies responsible for processing and reviewing permit applications.

- Makes recommendations for eliminating, consolidating, simplifying, expediting, or otherwise improving permit procedures affecting business enterprises.

What Types Of Small Businesses Receive The Most Funding?

Source: https://tinyurl.com/rn455ge

Wrtitte by: Jared Hecht

Getty

For nascent businesses, that might mean a small loan from your family or friends, but as your business continues to grow, you may have to explore the possibility of larger financing solutions from a bank or alternative lender. In fact, nearly half of all small businesses applied for a loan last year.

While almost any type of small business can qualify for a loan (a few industries, such as gambling or speculative house-flipping, may be blacklisted by lenders), some industries tend to obtain more funding than others.

Why would one industry qualify for more overall funding than another? Lenders consider businesses within some industries to be less risky and more likely to repay their debts, due to their potential for high revenue and profitability, among other factors.

Whether you’re still exploring the idea of starting a business and want to know which industries are most likely to receive funding, or you want to see what your chances are of being approved for a large chunk of capital for your existing business, knowing which businesses get the most funding can help you better plan for the future. Which Small Businesses Receive The Most Funding?

According to Fundera’s State of Small Business Lending Report 2020, these were the 10 industries that received the most funding from lenders in the prior 12 months:

- Retailing Electronics

- Auxiliary Health Services

- Alcohol

- Creative/Marketing

- Physicians/Doctors Office

- Strategy/General Consulting

- Manufacturing Other Merchandise

- Software Development

- Dentistry

- Hotel, Motel, Lodging

What Separates These Businesses From The Rest?

There are a few factors that make one small business—in the eyes of a lender—a safer bet to repay a loan than another. They include:

- Proof of revenue: Revenue is what gets you in the door for most lenders. Lenders will analyze several months of bank statements when reviewing a loan application, which will give them a sense of the business’s average bank balance and how well they manage their money. If you show an ability to generate revenue based on a solid business model, many lenders will be interested in working with you.

- Profitability: It’s one thing to generate money—it’s another to generate profits. Only businesses that are profitable (and highly profitable, at that) will qualify for large, long-term loans such as bank loans and SBA loans.

- Good personal and business credit scores: Showing that you have a history—as both an individual and a business owner—of repaying your debts on time is, of course, a great sign to lenders.

- Time in business: The longer you’ve been in business, the better you look to a lender. A brand-new business (even one that makes a ton of money out of the gate) can’t demonstrate the longevity that one with a decade of business history can. Lenders want to work with businesses that will be around for a while—and if you’ve already shown you can do that, all the better.

The Biggest Difference-Maker: SBA Loans

It’s worth noting that businesses that took out SBA loans received significantly more capital than those that funded through an alternative lender.

Not every business can qualify for an SBA loan. These are loans partially backed by the federal government, which means only businesses that can meet the requirements (which vary by SBA-lending bank, but may include strong personal credit scores or profitability) will be considered.

According to the SoSBL report, the average short-term loan through Fundera was for $52,709. The average SBA loan through Fundera? Over $211,300.

No wonder that industries like Creative/Marketing, Strategy/General Consulting, and Auxiliary Health Services made the short-list for most overall funding: They were all in the top-five in terms of businesses that received the most SBA loans last year.

Basically, if you’re eligible for an SBA loan—and you have a business need that correlates to one of the use cases for SBA loans, such as expansion or buying commercial real estate—you’re more likely to qualify for substantially more business funding than a business that isn’t.

What Does This Mean For Your Business?

If your business isn’t in one of these top-10 industries, that doesn’t mean you won’t be able to qualify for significant funding (assuming you need it).

It is worth noting what these top industries have in common—namely, a higher likelihood of demonstrating profitability and longevity.

If your business has trouble turning a consistent profit, is still young (less than two years in business), or has a middling credit history (perhaps due to some ill-advised purchases with a business credit card early on in your career), it’s time to start improving those facets of your business. That might mean adjustments to your business model, taking out a new business credit card, or continuing to operate until you’ve been in business long enough to justify a major loan.

Taking out a loan may not make or break your business—you may never need a loan, after all. But performing well on these metrics is a good goal for any business owner. Plus, you’ll be more likely to qualify for the best loan products on the market, if the day where you need a little extra help growing your business does come.

Hispanic Entrepreneurs Bullish on 2020 Business Outlook, With Revenue Projections Rising to Four-Year High

Source: https://tinyurl.com/s4a7bv3

Nine in 10 Plan to Grow their Business in the Decade Ahead

U.S. Hispanic small business owners anticipate a decade of robust expansion and growth, expressing a brighter business outlook than their non-Hispanic peers in the year ahead, according to the fourth annual Bank of America Business Advantage 2020 Hispanic Business Owner Spotlight.

The annual study based on a survey of more than 1,000 entrepreneurs across the country reveals:

Outlook remains strong for Hispanic entrepreneurs, exceeding that of their non-Hispanic peers.

Hispanic entrepreneurs see the 2020s as a decade of opportunity.

A strong majority of Hispanic business owners (92%) believe the small business environment will strengthen for their community over the next five years, and 90% have set ambitious goals to advance or grow their business in the new decade. Specifically, their top five goals over the next 10 years include: significantly increasing revenue (57%), prioritizing the digital presence of their business (45%), expanding into new markets (34%), significantly increasing staff (30%), and automating business operations (29%).

Hispanic entrepreneurs still bullish, yet confidence in the economy is down slightly year over year.

Economic concerns decline, yet remain elevated over their non-Hispanic counterparts.

A sizeable majority of Hispanic entrepreneurs (72%) report that efforts to grow their business face distinct challenges, citing lack of resources (21%), lack of expertise in back office management (21%) and challenges accessing capital (20%) as the top three barriers.

For an in-depth look at the insights of the nation’s Hispanic small business owners, read the full Bank of America Business Advantage 2020 Hispanic Business Owner Spotlight.

Providing a business advantage to small business owners

Bank of America provides advice, solutions, access to capital and dedicated support to meet the unique needs of our 12 million small business owner clients. We originated $9.2 billion in new loans to small business clients in 2019, up 7% from 2018. According to the FDIC, Bank of America also maintained its position as the nation’s top small business lender at the end of the third quarter of 2019, with $37.6 billion in total outstanding small business loans (defined as business loans in original amounts of $1 million and under), up 8% year over year. In 2019, Bank of America booked more than 339,000 low- and moderate-income (LMI) loans totaling $6.3 billion, which was more than half of the company’s total small business lending. The company is a top lender in the SBA’s 504 and 7(a) programs, and a leading investor in community development financial institutions (CDFIs) – with a portfolio of nearly $1.6 billion invested across the U.S., of which, nearly $400 million is invested in CDFIs focused on U.S. small businesses.

Serving the Hispanic-Latino community

Bank of America is proud of its long-standing commitment to creating a diverse and inclusive environment for our employees and supporting diverse customers, communities and businesses around the world. We currently serve 9.5 million Hispanic-Latino clients, and more than 1 million Hispanic-Latino business owners. By the end of 2019, Bank of America had more than 2 million users on its Spanish language mobile app, growing by more than 20% year over year. Additionally, nearly two-thirds of Bank of America financial centers are staffed by employees with bilingual capabilities, and more than 4,000 multilingual teammates staff our financial centers located in LMI areas.

Nine in 10 Plan to Grow their Business in the Decade Ahead

U.S. Hispanic small business owners anticipate a decade of robust expansion and growth, expressing a brighter business outlook than their non-Hispanic peers in the year ahead, according to the fourth annual Bank of America Business Advantage 2020 Hispanic Business Owner Spotlight.

The annual study based on a survey of more than 1,000 entrepreneurs across the country reveals:

Outlook remains strong for Hispanic entrepreneurs, exceeding that of their non-Hispanic peers.

- 89% of Hispanic entrepreneurs plan to expand over the next 12 months (vs. 68% of non-Hispanic entrepreneurs, and up slightly from 87% in 2019).

- 79% expect their revenue to increase in the year ahead, a four-year high (vs. 57% of non-Hispanic entrepreneurs, and up from 74% in 2019).

- 45% plan to hire in 2020 (vs. 24% of non-Hispanic entrepreneurs, and down from 51% in 2019).

- 78% plan to obtain financing over the next 12 months (vs. 49% of non-Hispanic entrepreneurs). The top three ways Hispanic entrepreneurs intend to obtain financing include tapping into personal savings (38%), applying for a bank loan (31%) and using personal credit cards (23%).

Hispanic entrepreneurs see the 2020s as a decade of opportunity.

A strong majority of Hispanic business owners (92%) believe the small business environment will strengthen for their community over the next five years, and 90% have set ambitious goals to advance or grow their business in the new decade. Specifically, their top five goals over the next 10 years include: significantly increasing revenue (57%), prioritizing the digital presence of their business (45%), expanding into new markets (34%), significantly increasing staff (30%), and automating business operations (29%).

Hispanic entrepreneurs still bullish, yet confidence in the economy is down slightly year over year.

- 62% of Hispanic entrepreneurs are confident their local economy will improve in the year ahead (vs. 52% of non-Hispanic entrepreneurs, and down from 68% in 2019).

- 53% are confident the national economy will improve over the next 12 months (vs. 49% of non-Hispanic entrepreneurs, and down from 59% in 2019)

Economic concerns decline, yet remain elevated over their non-Hispanic counterparts.

- Health care costs remain the most worrisome economic issue for Hispanic entrepreneurs (63%), though concern fell to the lowest level since the survey began in 2017.

- Other top concerns of Hispanic business owners in 2020 include the political environment (59%), strength of the U.S. dollar (59%), commodities prices (56%), consumer spending (56%) and interest rates (55%).

- Compared to their non-Hispanic peers, Hispanic entrepreneurs expressed notably greater concern around commodities prices (56% of Hispanic entrepreneurs vs. 43% of non-Hispanic), credit availability (50% of Hispanic vs. 36% of non-Hispanic) and climate change (45% vs. 34%).

A sizeable majority of Hispanic entrepreneurs (72%) report that efforts to grow their business face distinct challenges, citing lack of resources (21%), lack of expertise in back office management (21%) and challenges accessing capital (20%) as the top three barriers.

For an in-depth look at the insights of the nation’s Hispanic small business owners, read the full Bank of America Business Advantage 2020 Hispanic Business Owner Spotlight.

Providing a business advantage to small business owners

Bank of America provides advice, solutions, access to capital and dedicated support to meet the unique needs of our 12 million small business owner clients. We originated $9.2 billion in new loans to small business clients in 2019, up 7% from 2018. According to the FDIC, Bank of America also maintained its position as the nation’s top small business lender at the end of the third quarter of 2019, with $37.6 billion in total outstanding small business loans (defined as business loans in original amounts of $1 million and under), up 8% year over year. In 2019, Bank of America booked more than 339,000 low- and moderate-income (LMI) loans totaling $6.3 billion, which was more than half of the company’s total small business lending. The company is a top lender in the SBA’s 504 and 7(a) programs, and a leading investor in community development financial institutions (CDFIs) – with a portfolio of nearly $1.6 billion invested across the U.S., of which, nearly $400 million is invested in CDFIs focused on U.S. small businesses.

Serving the Hispanic-Latino community

Bank of America is proud of its long-standing commitment to creating a diverse and inclusive environment for our employees and supporting diverse customers, communities and businesses around the world. We currently serve 9.5 million Hispanic-Latino clients, and more than 1 million Hispanic-Latino business owners. By the end of 2019, Bank of America had more than 2 million users on its Spanish language mobile app, growing by more than 20% year over year. Additionally, nearly two-thirds of Bank of America financial centers are staffed by employees with bilingual capabilities, and more than 4,000 multilingual teammates staff our financial centers located in LMI areas.

Tuesday, March 3, 2020

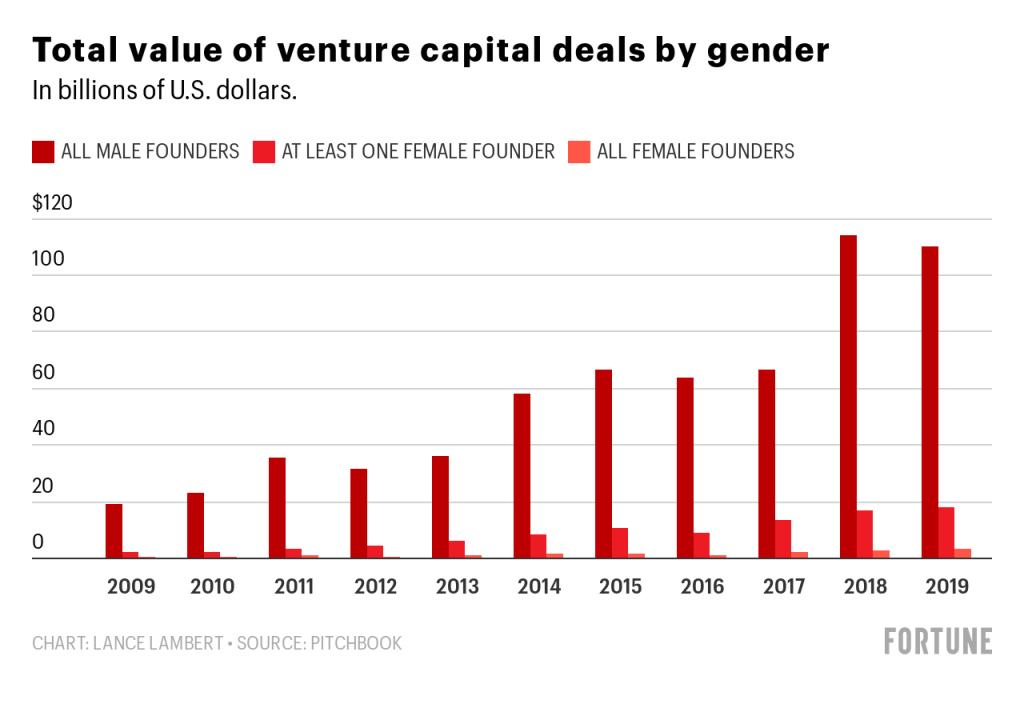

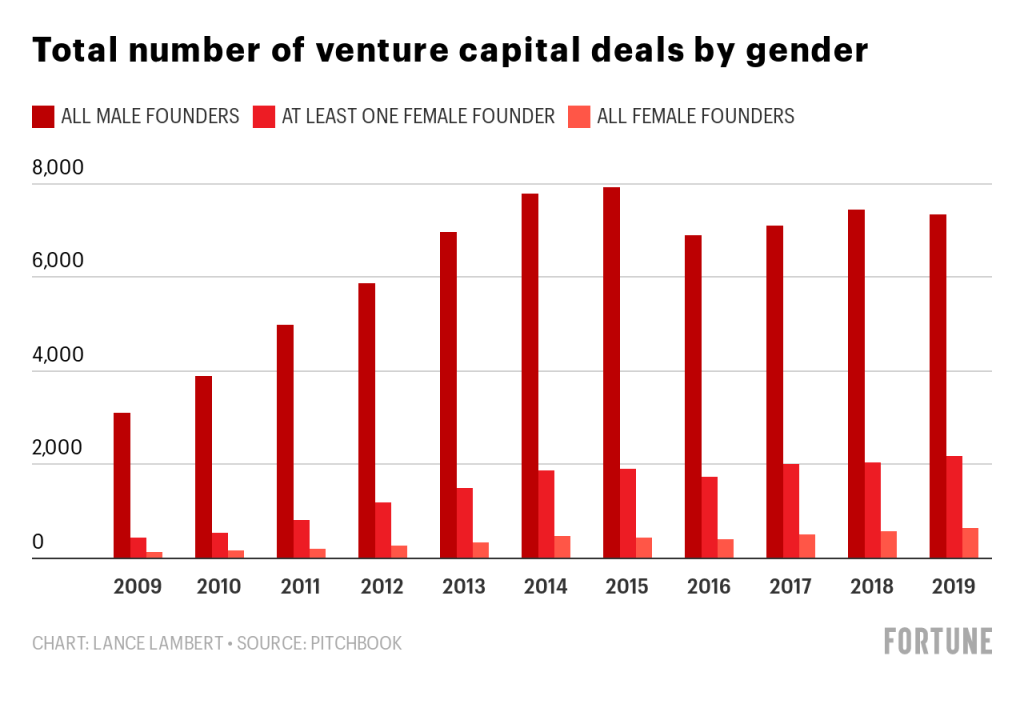

Funding for female founders increased in 2019—however only to 2.7%

Source: https://tinyurl.com/rhawysb

How will have to female founders mirror on 2019? From a statistical standpoint, the 12 months may just for sure be observed as step ahead: the proportion of VC greenbacks that flowed into startups based via a girl or a gaggle of ladies crept up over 2019, hitting $3.54 billion, or 2.7% of general funding.